If you’ve been investing for even five minutes, you’ve probably heard someone say: “Should I buy XEQT or VEQT?”

These two ETFs have become the default answer for Canadian investors who want a simple, set-it-and-forget-it way to invest.

But here’s the thing:

Everyone’s obsessing over them… and I’m not.

Let’s break this down honestly, without hype.

What Exactly Is an “All-In-One ETF”?

Before comparing XEQT and VEQT, it helps to understand what these products actually are.

An all-in-one ETF is basically a complete investment portfolio inside a single fund.

It gives you:

- Global diversification

Automatic rebalancing

A mix of stocks from around the world

A simple, hands-off experience

Instead of buying 4–5 ETFs on your own and rebalancing them every year, an all-in-one ETF does it automatically.

Think of it like buying the entire world stock market in one click.

That’s why these products exploded in popularity.

A Quick History of XEQT and VEQT

Even though it feels like they’ve been around forever, both ETFs are pretty new:

VEQT launched in January 2019

XEQT launched in August 2019

These releases kicked off the “turnkey portfolio” era — easy portfolios for people who don’t want to build everything from scratch.

The Most Fair Comparison

VEQT had a 7-month head start.

So comparing “since inception” gives it an unfair advantage.

To keep it fair, we compare from August 7, 2019 — XEQT’s official launch date.

Total Returns (Aug 2019 → Today)

XEQT: +123.16%

VEQT: +118.09%

Annualized Returns

XEQT: ~13.60% per year

VEQT: ~13.18% per year

Both are excellent returns — but the sample is extremely short (6 years) and includes one of the most chaotic cycles in history:

2020 crash

2020–2021 massive rebound

Tech bubble 2.0

Inflation shock

Rate hikes

2023–2024 bull run

Amazing results… but definitely not “normal.”

Expect the next 10–20 years to look calmer and more average.

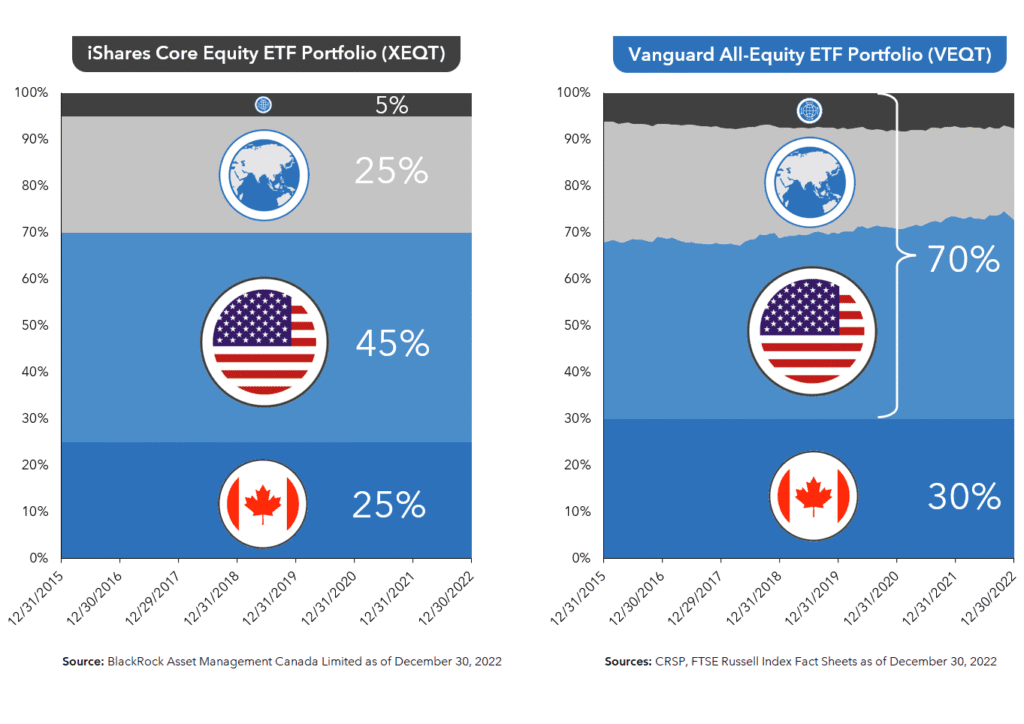

What’s Actually Inside XEQT and VEQT?

This is where the ETFs differ — just slightly.

Both funds own thousands of stocks through underlying ETFs.

Here’s a simplified breakdown:

XEQT (iShares)

Slightly more US stocks.

Typical weights (approximate):

US stocks: ~46%

International developed markets: ~26%

Emerging markets: ~6%

Canada: ~22%

Top underlying holdings include:

Apple

Microsoft

Amazon

Nvidia

Alphabet

…through the iShares core ETFs (XUU, XEF, XEC, XIC)

VEQT (Vanguard)

Slightly more Canadian stocks.

Typical weights (approximate):

US stocks: ~43%

International developed markets: ~29%

Emerging markets: ~6%

Canada: ~22–25%

Top underlying holdings include:

Apple

Microsoft

Royal Bank of Canada

Shopify

TD Bank

…through Vanguard’s core ETFs (VUN, VIU, VEE, VCN)

Why the Returns Are So Similar

Both portfolios are built using the same ingredients — global equities, with very similar weights.

The only real differences are:

XEQT → slightly more US

VEQT → slightly more Canada

And yes — Canada is only ~3% of the world market, so the impact is small.

Management Fees: Also Nearly Identical

XEQT: 0.20%

VEQT: 0.17%

On a $100,000 portfolio:

XEQT → $200 per year

VEQT → $170 per year

A difference of $30.

Not exactly retirement-destroying.

So… Which One Should You Choose?

Here’s the truth:

Both do their job extremely well.

They’re simple, diversified, reliable, and built for long-term growth.

The real question isn’t: 👉 “XEQT or VEQT?”

It’s: “Are you willing to stick with any ETF through market ups and downs for the next 20 years?”

Consistency matters more than the logo on the ETF.

If you prefer:

US-heavy exposure → XEQT

More Canada in the mix → VEQT

Pick one and move on with your life.

Your wealth won’t be decided by 0.03% in fees or a 2–3% difference in country weighting.

It will be decided by your discipline and time in the market.

Ready to take control of your finances—for real this time?

Want a step-by-step system to set this up?

Download your FREE copy of Your Financial Empowerment Starter Kit.

It will walk you through the habits and tools to start moving your money with purpose.