Want to become a millionaire?

Here’s the part nobody believes at first: you don’t need a windfall, a perfect stock pick, or 12 screens blinking red and green. You need a margin, a plan, and time to become a millionaire.

A few weeks ago I was sketching on a whiteboard with a client—we’ll call him Mark. He was exhausted from chasing “hot tips,” convinced that wealth only happens to people who gamble big or get lucky. I drew two lines: one straight, one curved. “This,” I said, tapping the straight line, “is what it feels like when you just save.” Then I traced the curve. “And this is what happens when your dollars start earning—and then those earnings start earning.” His face changed. Not because the math was complicated, but because it was simple.

Here’s the simple part:

- Invest $1,000/month for 25 years.

- Earn a long-term average return of ~9% a year (think: broad market index ETF).

- You’re in the neighbourhood of $1.1M by the end.

And here’s the part that makes it feel doable for different stages of life:

- Start at 25, invest $350/month for 40 years (to age 65).

- At 8–9% average yearly returns, you’re still in seven figures by retirement.

I’m not promising anyone a guaranteed number—markets don’t do guarantees, and currency swings matter for Canadians who hold U.S. equities through an ETF. I’m promising a repeatable system: create investable margin, invest it automatically (TFSA and RRSP are your best friends), and let time be your unfair advantage. Think snowball on a long hill. The hill does most of the work.

And yes, I can already hear the pushback: “Jo, where am I supposed to find an extra $1,000 a month?” Great question. This article is about those levers—income, fixed costs, and consistent investing—and how to pull the right one for your situation without guilt, overwhelm, or gimmicks.

Before we talk tactics, let’s get the millionaire math out of the way—cleanly, clearly, and in plain language.

The Millionaire Math

Compound Growth Made Simple

Let’s de-mystify compounding with real numbers you can feel in your gut, not just nod at.

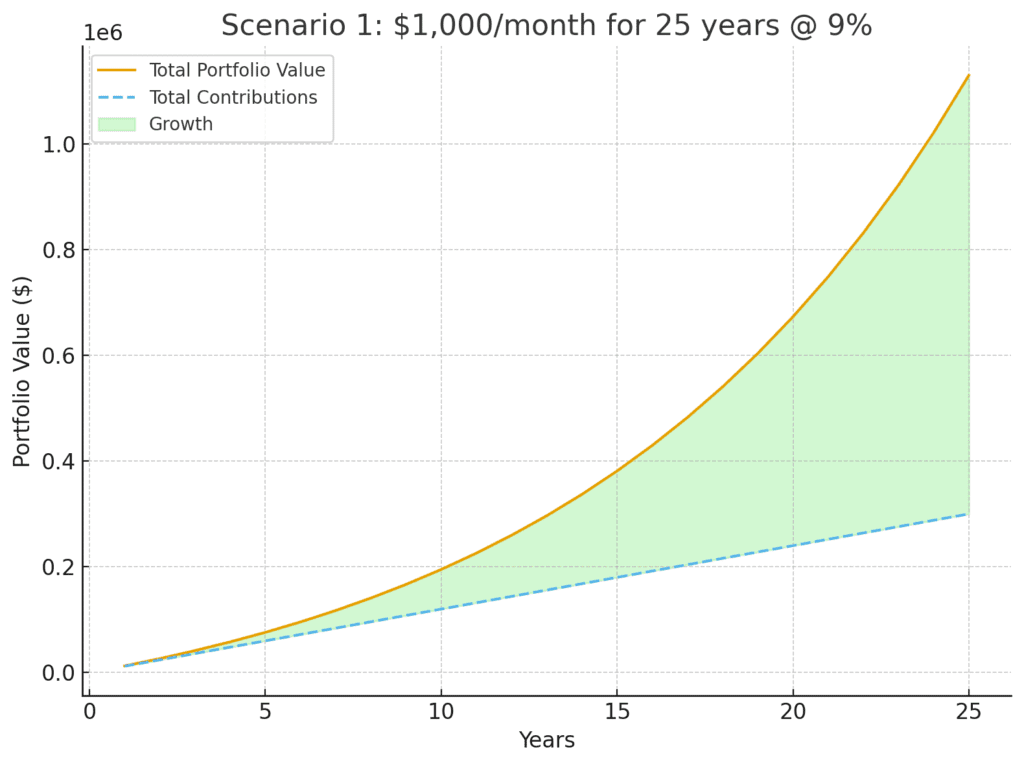

The $1,000/month for 25 years example

- Your contributions: $1,000 × 12 × 25 = $300,000.

- Potential outcome at ~9% average: ~$1,121,000.Growth (what your money earned): ~$821,000.

Read that again. Roughly 73% of the final million isn’t the cash you put in—it’s the growth on your growth.

That’s compounding.

Analogy time: Imagine planting a small garden. In year one you harvest a little. You save the seeds and plant them again—with last year’s seeds plus the new ones. Fast-forward and your garden looks “unfair.” It’s not. You just let the seasons do their thing, over and over.

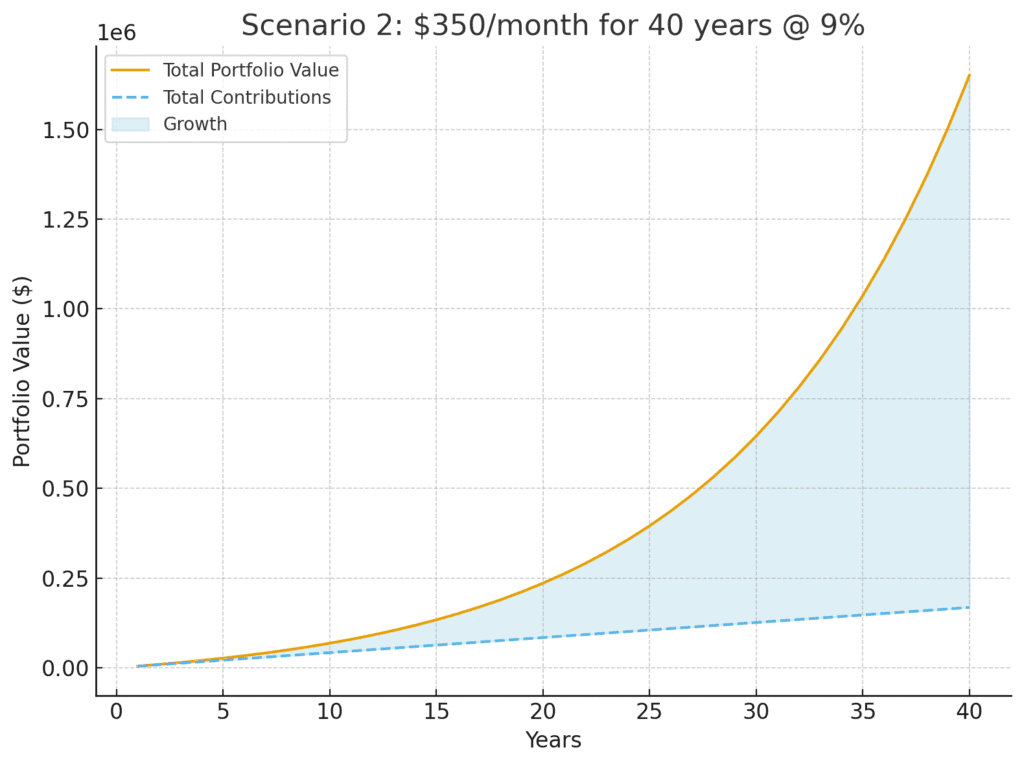

“I’m starting younger—what if I only have $350/month?”

Perfect. Starting early is like putting your garden on a sunnier slope.

- Your contributions: $350 × 12 × 40 = $168,000.

- Potential outcome at ~9% average: ~$1,638,000.

- Growth: ~$1,470,000 (about 90% of the total!).

Even if returns average closer to 8%, you’re still around $1.22M.

At 7%, you land just under $920K—still life-changing for most households, especially inside a TFSA/RRSP where the tax treatment compounds the benefit.

Key insight: the earlier you start, the less you personally have to contribute to reach a big number, because time does more of the heavy lifting.

Why “capital vs. growth” matters (and motivates)

Most people think wealth comes from brutally high savings rates. And yes, a healthy margin matters. But the engine is time in the market. Showing the split between what you put in (capital) and what the market added (growth) reframes investing from “I have to pinch pennies forever” to “I need a system that buys me time.”

Here’s that split, side-by-side:

- $1,000/month × 25 years @9% → $300K contributed / ~$821K growth

- $350/month × 40 years @9% → $168K contributed / ~$1.47M growth

The takeaway isn’t “aim for 9% every year” (you won’t). It’s “get invested, stay invested, and let compounding have a long runway.” In Canada, prioritize TFSA for tax-free growth and use RRSP strategically (especially if you’re in a higher tax bracket today than you expect in retirement).

A quick reality check (because I refuse to sell fairy tales)

- Returns aren’t linear. You won’t get a smooth 8–9% every year. Some years are ugly. That’s normal.

- Currency matters. If you use a Canadian ETF that tracks the S&P 500, CAD/USD moves will impact returns in CAD terms. Over long periods, the equity risk dominates, but it’s worth noting.

- Fees matter. An extra 1–2% in fees is a quiet thief. Use low-cost index ETFs to keep more of your growth.

A tiny story to make it real

Two friends—Amira and Dan—both want seven figures by 65.

- Amira starts at 25 with $350/month. She invests through her TFSA automatically on payday. She forgets about it (on purpose).

- Dan waits until 40 to “start seriously.” He puts in $1,000/month and tells himself he’ll “catch up later.”

At 65, Amira, the “small but early” investor, didn’t just catch up—she likely lapped Dan. Not because she’s a genius. Because she let time be her teammate for an extra 15 years.

“But what if I can’t find $1,000—or even $350—right now?”

That’s where the rest of this article goes next: creating investable margin. If your income is under ~$60K, your lever is earn more (not micro-cutting joy from your life). If your income is over $100K and you still can’t find surplus, your lever is simplify fixed costs (mortgage/car/insurance). Different problems, different solutions. Same outcome: free up dollars, automate them into your TFSA/RRSP, and let compounding start the clock.

Micro-moves you can make this month (so momentum starts now)

- Automate a small transfer (even $100) into a TFSA-eligible index ETF. Let the habit precede the amount.

- Name your money: “Rent,” “Groceries,” “Investing,” “Fun.” Money with a job behaves better.

- Turn raises into contributions: every salary bump, increase the auto-transfer before you feel the lifestyle creep.

- Know your fee: if you’re paying >0.50% in fund fees, you’re likely donating future you’s money.

The punchline

Compounding is a force of nature disguised as boring math. The magic isn’t “picking winners.” It’s time × consistency × low friction. Your job is to set up a system that runs whether you’re motivated or not.

In the next section, we’ll separate two very different situations—and give each its own playbook:

- Income is the bottleneck (typically under ~$60K): how to raise the ceiling without burning out.

- Fixed costs are the bottleneck (often $100K+ earners): how to unlock margin without feeling deprived.

Because the worst strategy is to wait and do nothing. The best strategy is to start—small if you must—and let time do what time does.

When Income Is the Problem

Earning Under $60K

Let’s be real for a second. If you’re earning less than $60,000 a year in Canada, it’s not that you’re “bad with money.” It’s not that you’re drinking too much coffee at Tim Hortons or that Netflix is secretly draining your wealth. The challenge isn’t your daily choices—it’s your income ceiling.

There are plenty of people in this situation. They’re disciplined, they’re thoughtful, and yet they still feel like they’re running on a treadmill. Why? Because there’s simply not enough margin left over after covering housing, food, transportation, and taxes. You can’t invest what you don’t have.

This is where the traditional “just budget harder” advice completely misses the mark. You can’t squeeze blood from a stone. Cutting out a $5 latte isn’t going to unlock an extra $1,000 a month.

What will? Raising your income ceiling.

The Income Playbook: Raising the Ceiling

Here are practical levers you can pull if you’re under that $60K mark:

- Negotiate Your Salary

- Canadians often hesitate to negotiate—sometimes out of politeness, sometimes out of fear. But the truth is, even a 5–10% raise early in your career can snowball into hundreds of thousands of dollars over a lifetime.

- Think about it: if you earn $55K and negotiate up to $60K, that’s $5K a year. Invested consistently, it could mean six figures more by retirement.

- Pro tip: research salary benchmarks (Glassdoor, Indeed, or industry reports), document your wins, and practice your ask.

Switch Jobs Strategically

The biggest salary jumps often come from moving companies, not staying loyal.

I’ve seen clients double their salary within three years just by positioning themselves for higher-paying roles in their industry.

Don’t just chase money—chase roles with growth potential. That way you’re setting up your future ceiling too.

Start a Side Hustle That Fits Your Life

No, you don’t need the next Shopify empire. But you can absolutely monetize skills or time.

Common wins I’ve seen: tutoring (math, languages), digital freelancing (graphic design, copywriting), IT support, or even handyman services.

Think of it this way: your side hustle doesn’t have to be forever. It just has to be the bridge that creates your investment margin.

Leverage the Gig Economy (Short-Term Boosts)

Uber Eats, DoorDash, Instacart, rideshare, or seasonal contract work can be a way to generate a few hundred extra dollars a month.

It’s not glamorous, but remember: the goal isn’t to deliver pizza for 20 years—it’s to create margin now so your dollars start compounding.

Monetize Time or Services Others Don’t Want to Do

People pay for convenience. Yard work, snow removal, pet-sitting, moving help—all of these are services that don’t require specialized degrees but can pad your income quickly.

A Story to Ground This

Stephanie, was making around $50K as an administrative assistant. Every month she felt guilty she couldn’t set aside the “recommended” 15–20% for investing. Instead of cutting her already modest expenses, we looked at her income.

She asked for a raise (got 7%), picked up weekend tutoring in French, and within a year her income jumped by about $8K. More importantly, she now had about $600/month of margin she could invest. That’s not millionaire status overnight, but it changed her trajectory forever.

The Big Mindset Shift

Here’s the truth: if you’re under $60K and can’t invest, it’s not a failure—it’s a signal. The signal is: your next wealth-building move is to grow your income, not obsess over small expenses.

Think of it like fitness. If you’re trying to bench press 200 lbs but the bar won’t move, the solution isn’t to just “try harder.” You need to build muscle first. Income growth is that muscle. Once it’s stronger, you’ll lift the bar with room to spare.

Micro-Moves You Can Make This Month

- Research salary benchmarks for your role and set a plan to negotiate at your next review.

- Pick one side hustle or gig you can test this month (commit to just 5–10 hours).

- Reframe how you see your income: instead of thinking “I’m capped,” ask, “What’s the fastest path to an extra $250/month?”

Bottom line: If you don’t yet have the margin to invest $1,000/month—or even $350/month—that doesn’t mean the dream is dead. It just means your first lever is income. Raise the ceiling, create the margin, and the investing system takes over from there.

When Spending Choices Are the Problem

Earning Over $100K

Now, let’s flip the script.

What if you’re making six figures or close to it and you still can’t find money to invest? I’ve seen this countless times—people assume a higher salary automatically equals wealth. But here’s the kicker: a high income doesn’t protect you from living paycheck to paycheck if your lifestyle inflates just as fast.

I know engineers, consultants, and managers pulling in $120K, even $150K, who admitted they had “nothing left over” at the end of the month. Not because they were careless, but because their fixed costs silently locked them in.

The Fixed-Cost Trap

Think of your monthly expenses like cement. The more you pour, the harder it is to move. Fixed costs—housing, vehicles, debt, insurance—become financial cement. Once it sets, your flexibility is gone. Here’s how it usually shows up:

Oversized Mortgage

Buying “the dream home” at the top of your budget feels normal in Canada, especially in hot markets like Toronto, Vancouver, or even mid-sized cities where prices keep climbing.

But a mortgage that eats 35–40%+ of your income leaves no room for investing. You’re “house-rich, cash-poor.”

Car Payments that Eat Wealth

A brand-new SUV at $900/month over 84 months might not sound outrageous when you’re making $120K. But add insurance, maintenance, gas, and you’re easily dropping $1,200+ per month.

Invest that same amount in a TFSA, and over 25 years you’re looking at more than half a million dollars.

- Lifestyle Creep (The Silent Drain)

That bigger house needs nicer furniture. That higher salary justifies more expensive vacations. Suddenly the $200 dinners become the norm.

It’s not about guilt—it’s about awareness. Every dollar permanently absorbed by lifestyle creep is a dollar that doesn’t get to compound for you

A Quick Story

Daniel, was a software developer earning just over $100K. On paper, he should’ve been saving thousands each month. But when he mapped his cashflow, here’s what he saw:

- $2,500 mortgage + $600 property taxes + $300 utilities

- $900 car payment + $200 insurance + $150 maintenance/gas

- $500+ dining out, $200 subscriptions, $300 “miscellaneous”

At the end of the month? He had less than $300 left. On a six-figure income.

The solution wasn’t to cancel Netflix. It was to rethink the big-ticket items. Daniel downsized his car to a reliable used hatchback, freeing $800/month. He also refinanced his mortgage when rates dipped slightly, trimming another $250/month. In total, that gave him $1,000/month margin—and that’s when the wealth-building really started.

The Real Cost of “Nice Things”

It’s not that you shouldn’t have nice things. The problem is when “nice things” become anchors.

Here’s a simple way to test a purchase:

Take the monthly cost and multiply it by 300.

Why 300? Because that’s roughly how much $1/month becomes over 25 years if invested at 9%.

- That $900 SUV payment? $270,000 of future wealth.

- That $300 “just a little bigger” mortgage payment? $90,000 of future wealth.

Suddenly, the true cost is clear.

Micro-Moves for High Earners

If you’re in the $100K+ bracket and struggling to invest, here’s how to break free:

- Audit Your Fixed Costs: list your mortgage, vehicles, insurance, and other recurring expenses. Highlight which ones are negotiable or downsizable.

- Roommate or House Hack: renting out a basement suite, Airbnb-ing a spare room, or splitting housing costs can unlock thousands.

- Rethink Vehicles: buy slightly used, pay cash if possible, or lease only if it aligns with your cashflow and lifestyle.

- Redirect Raises and Bonuses: lifestyle creep kicks in when raises become upgrades. Instead, funnel them straight into investments.

- Cap Lifestyle Spending: pick a percentage (say 20% of take-home) for “fun.” That way, you enjoy your income without letting it balloon.

A Mindset Reframe

At $100K+ income, you’re not in survival mode—you’re in decision mode. The question isn’t, “Can I afford this?” It’s, “Is this purchase worth trading for future freedom?”

Remember: financial freedom isn’t about living small. It’s about giving your future self the same lifestyle—without needing to clock in at 9 a.m. forever.

The Core Principle

Earn More, Spend Smart, Invest the Rest

At this point, you’ve probably noticed a theme. Whether you’re earning less than $60K or well over $100K, the formula for building wealth doesn’t change. The levers do. But the core principle stays the same:

Earn more, spend smart, invest the rest.

Sounds simple, right? Almost too simple. But here’s the thing—most people get stuck because they either:

- Focus only on earning more but let lifestyle creep eat every dollar.

- Or obsess over cutting expenses but never increase their income ceiling.

The magic is in the combination.

Think of It Like a Three-Legged Stool

Imagine trying to sit on a stool with only two legs. Not very stable, right? Building wealth works the same way.

- Leg 1: Earn More. This creates the fuel. More income means more potential margin.

- Leg 2: Spend Smart. This protects the fuel from leaking out through unnecessary fixed costs or mindless consumption.

- Leg 3: Invest the Rest. This multiplies the fuel by putting it to work through compounding.

Take away any one leg, and the stool tips. You need all three to sit comfortably on financial freedom.

Automating the “Rest”

Here’s where most people go wrong: they wait to see what’s “left over” at the end of the month and invest that. Spoiler: it’s usually nothing.

Instead, flip the order:

- Decide your monthly investment number (it doesn’t have to be $1,000 right away—start with $100, $250, whatever creates momentum).

- Automate it into your TFSA or RRSP on payday, before lifestyle spending has a chance to claim it.

- Live on the rest.

This way, investing isn’t “extra.” It’s built in. You wouldn’t skip rent or your phone bill, right? Treat your future freedom the same way.

Canadian Context: Where to Put “the Rest”

For Canadians, the smartest order usually looks like this:

- TFSA first. Every dollar grows tax-free, and withdrawals don’t count as income. Perfect for compounding.

- RRSP next. Especially if you’re in a higher tax bracket now and expect to be lower later (common for six-figure earners).

- Non-registered accounts once you’ve maxed the first two.

Bonus tip: Automate contributions into low-cost index ETFs. Think of them as the “set it and let it run” engine of your wealth system.

A Quick Example

This couple, let’s call them Emily and Raj. Both earned solid salaries—around $90K each—but were frustrated because they couldn’t seem to save more than a few thousand a year.

When we mapped it out, they were doing what everyone else was doing: waiting until the end of the month to see what was left, then transferring whatever scraps remained.

They flipped the script. They set up $1,200/month in automatic transfers to their TFSAs (split evenly). Suddenly, it wasn’t optional—it was just part of life, like paying Hydro or daycare.

One year later, not only had they invested nearly $15K without stress, but they barely noticed the difference in day-to-day life. Why? Because they adjusted to living on what remained. Their “financial stool” finally had all three legs.

Key Insight

Wealth isn’t built by chasing shortcuts. It’s built by:

- Creating margin (earning more, spending smart).

- Protecting margin (avoiding lifestyle creep, keeping fixed costs lean).

- Deploying margin (automating investments).

Repeat long enough, and you’ve got financial freedom—not in theory, but in practice.

Conclusion

Building Wealth Is Simple, Not Easy

Here’s the truth most people don’t want to hear: becoming a millionaire isn’t magic—it’s math.

- If you start early, even $350/month can snowball into seven figures by retirement.

- If you start later, you’ll need to commit more—around $1,000/month for 25 years.

- Either way, the formula is the same: earn more, spend smart, invest the rest.

If your income is under $60K, the lever is income growth. Don’t beat yourself up over coffee runs—you need to raise the ceiling. If you’re pulling in six figures but feel broke, the lever is fixed costs. Trim the anchors that weigh you down.

And for everyone, regardless of income, the lever that matters most is time. The earlier you start investing—even small amounts—the more your money compounds. Remember, in both scenarios we looked at, most of the millionaire outcome wasn’t from your contributions. It was from growth on your growth.

The worst strategy is to wait and do nothing. The best strategy is to start, even if it feels small.

Let’s make this practical for you.

- Reflect: Which lever do you need to pull first—income, expenses, or both?

- Action step: Open your banking app right now and set up a recurring transfer, even if it’s $100/month. Momentum beats perfection.

- Share: Know someone who says “I’ll start investing later”? Send them this article. You might change their timeline—and their life.

And if you want to go deeper, grab your free copy of Your Financial Empowerment Starter Kit. It’ll walk you through the systems and checklists to put these principles into action.

Final Thought

Building wealth isn’t about deprivation or impressing your neighbours. It’s about designing a system that lets your future self live with freedom. You don’t need to be a financial genius, and you don’t need to day trade. You just need to start, stay consistent, and let time do the work.

Because the millionaire version of you? They’re not 25 years away. They’re right here—making their first smart move today.